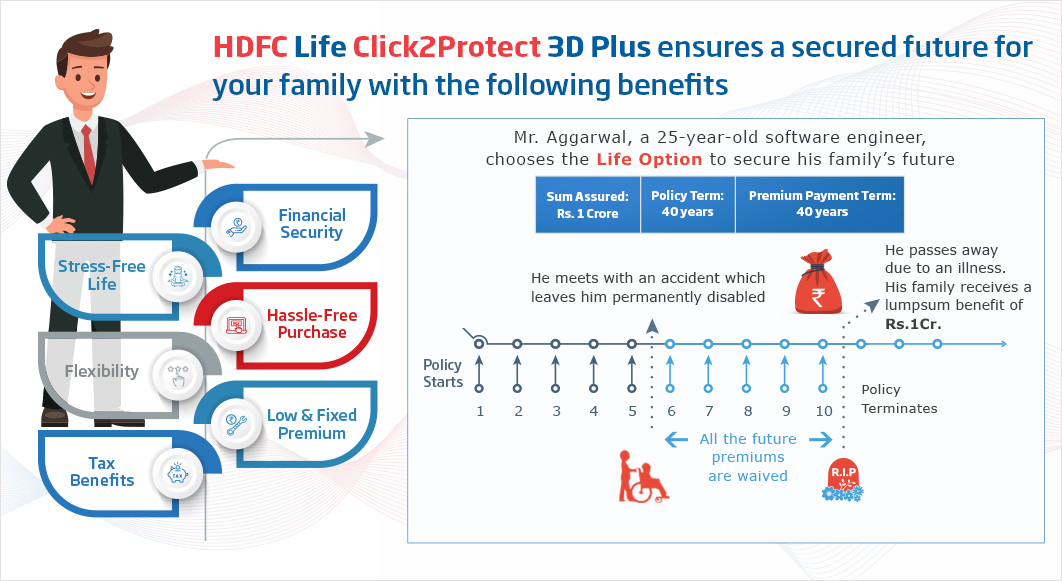

In the event of a conflict among the Policy, Certificate, and/or Trust Agreement and this document, the Policy, Certificate, and/or Trust Agreement will prevail. The entire terms are contained in the Application, Policy, Certificate, and/or Trust Agreement. It does not include all the terms of coverage. This benefit is intended to be a brief outline of benefits available to you and your eligible dependents. Note: Minnesota Life Insurance Company underwrites the Minnesota Life Voluntary Group Term Life Insurance coverage. Covered Personġ The amount of insurance on an employee and spouse 65 or older shall be a percentage of the amount otherwise provided by the plan of insurance applicable to such employee in accordance with the table found in the Life Insurance Plan Document (pages 4 & 6). For additional information on this benefit, including timing for enrollment opportunities, see the life insurance page. If you are unsure whether you are eligible for this benefit, go to Benefit Eligibility. Provided you have been Totally Disabled for at least 6 consecutive months.Employees can purchase additional insurance for themselves, eligible spouse and/or child(ren) at group rates through the Voluntary Group Term Life Insurance (VGTLI) program. Total disability will not exist while the Life Insured is engaged in any gainful occupation. Life insurance policies can become obsolete or. Insured's incapacity, caused by disease or bodily injury, to engage in any daily activity of living. Did you know you can sell all or a portion of a life insurance policy, even term insurance (5-minute read). If the Life Insured has no gainful occupation, "totally disabled" or "total disability" means the Life Of any one continuous period of total disability, it means the Life Insured's incapacity to engage inĪny gainful occupation for which the Life Insured is or may become reasonably fitted by education, Car repair insurance could protect you from an unexpected expense, like paying for a busted air conditioning unit. Injury, to perform any and every duty pertaining to such occupation, and after twenty-four (24) months If you’re 55 and under at the time of application, you can add this option so you won’t have to pay your premiums while you’reĭisabled If the Life Insured has a gainful occupation, "totallyĭisabled" or "total disability" means the Life Insured's incapacity, caused by disease or bodily You also have the option to convert your term policy to permanent life insurance without any further medical exams or health questionnaires footnote 2.You can exchange a 15 year term policy for a new 20, 25 or 30 year term policy, if your needs change footnote 1.You can exchange a 10 year term policy for a new 15, 20, 25 or 30 year term policy, if your needs change footnote 1.Choose how much coverage you need from $100,000 to $5 million.Coverage expires after the initial term and cannot be renewed

Term life insurance covers a specific time period and provides financial help.

#Term life insurance calculator how to

We’ll walk you through how to use our calculator and. At the end of the term, coverage may be renewed by paying a different premium. Bankrate’s life insurance calculator helps you hone in on the factors that affect the level of life insurance coverage you may want to buy. Your premiums stay the same for that term. The amount of your coverage is for a set period (the term). pay for any other short-term financial obligations.

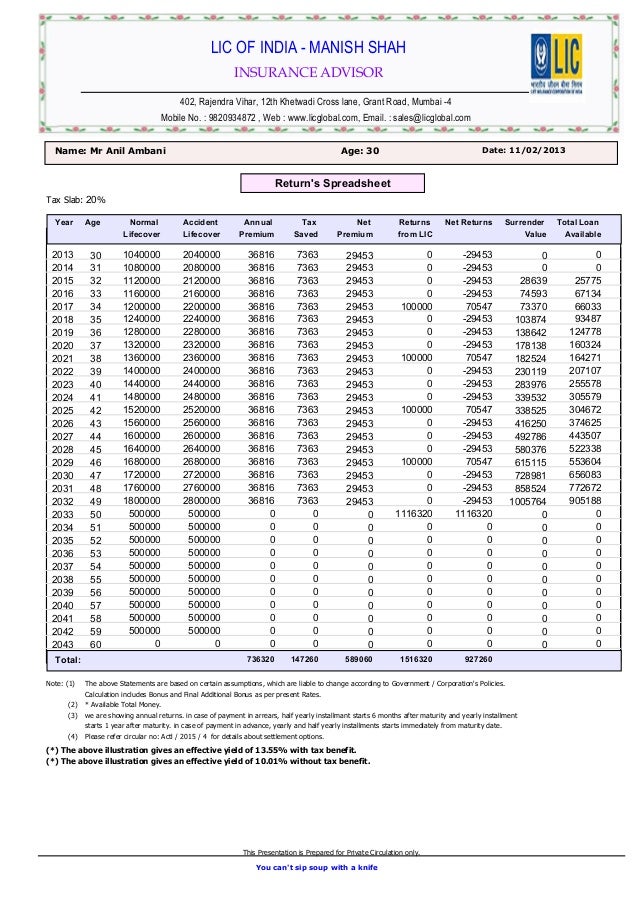

Term life insurance is a simple form of life insurance to help you financially protect your family if your surviving family needed access to cash to: Group Term Life Insurance : Rate Calculator and Comparison Tool. Having a life insurance plan is an important decision which can shape the financial future of yourself and your family.

0 kommentar(er)

0 kommentar(er)